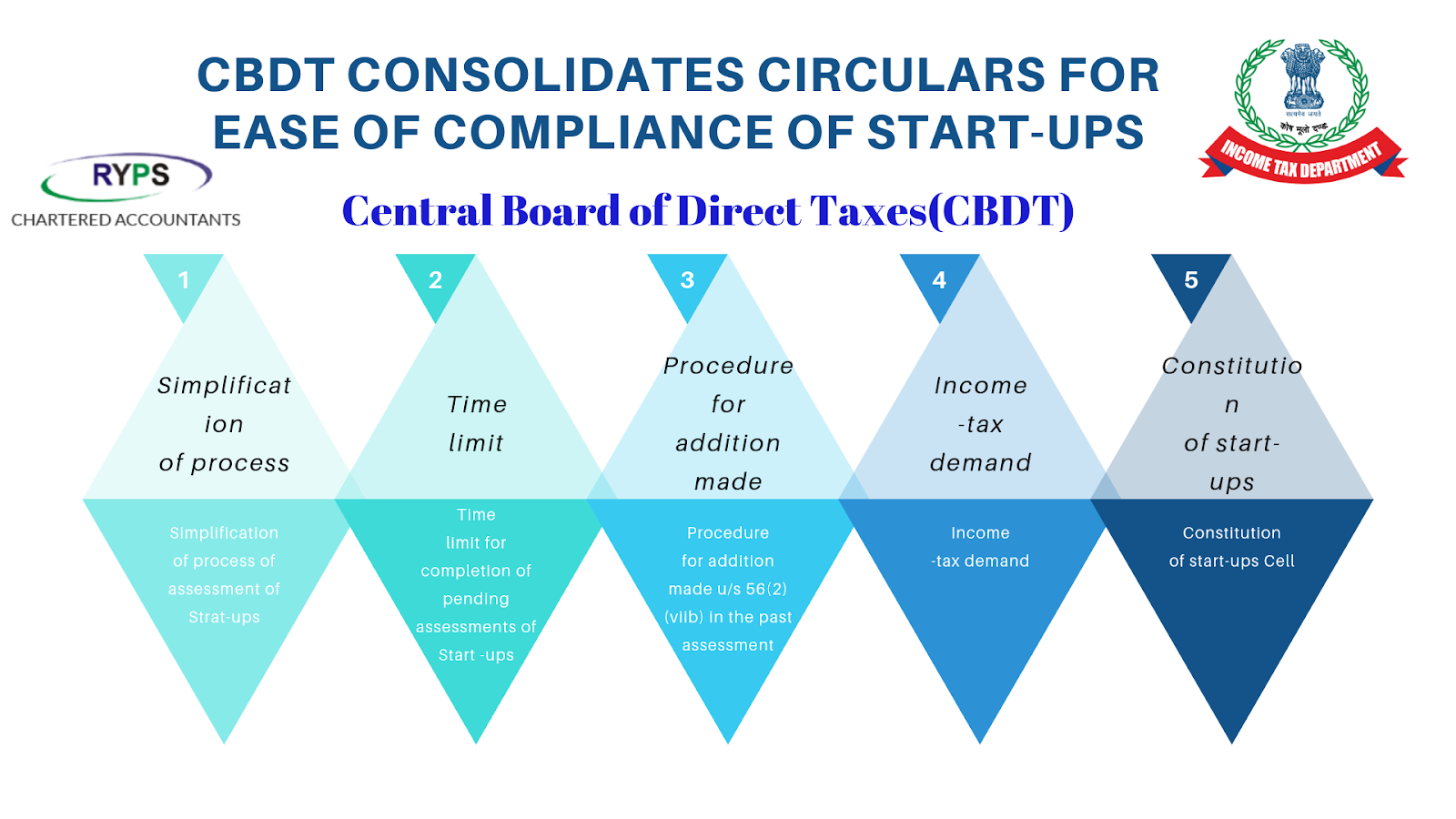

CBDT CONSOLIDATES CIRCULARS FOR EASE OF COMPLIANCE OF START-UPS

In order to provide hassle -free tax environment to the Start-ups. CBDT issued various circulars / clarifications on a series of announcement have been made by Finance Minister Smt. Nirmala Sitharaman in her General Budget 2019 and also on 23rd August 2019. The present circular inter alia highlights the following: -

i) Simplification of process of assessment of Strat-ups – Circular No 16/2019 dated 7th of August 2019 provide for the simplified procedure of assessment of Start-ups recognized by DPIIT . the circular covered cases under “limited scrutiny “, cases where multiple issues including issue of section 56(2)(viib) were involved or cases where Form No 2was not filed by the start-ups entities.

ii) Time limit for completion of pending assessments of Start -ups: All cases involving “ limited scrutiny “ were to be completed preferably by 30th September 2019 and the other cases of start-ups were to be disposed off on priority preferably by 31st October 2019.

iii) Procedure for addition made u/s 56(2)(viib) in the past assessment: vide clarification issued on 9th August 2019 it was provided that the provision of section 56(2)(viib) of the Act would also not be applicable in respect of assessment made before 19th February 2019 if a recognised start- ups has filed Form No 2. The timelines for disposal of appeals before CsIT (Appeals) was also specified. Further, the addition made under section 56 (2)(viib) would also not be pressed in further appeal .

iv) Income -tax demand: It has been reiterated time and again by CBDT that outstanding income -tax demand relating to addition made under section 56(2)(viib) would not be pursued and no communication in respect of outstanding demand would be made with the start- ups entities . other income tax demand of start-ups would not be pursued unless the demand was confirmed by ITAT.

v) Constitution of start-ups Cell: Vide order dated 30.08.2019, CBDT has constituted a start-up cell under the aegis of Member (IT & C), CBDT to redress grievances and to address various tax related issues in the case of start-ups.

Author

CA Pooja Shukla FCA

RYPS & ASSOCIATES LLP

Website:www.ryps.in

Contact No: 9810505547

Comments

Post a Comment