HOW APPLY FOR PROVISIONAL REFUND IN CASE OF EXPORT UNDER GST REGIME

Exporter can apply for provisional refund in the application form RFD 01 after receiving application by the officer .if there is no any deficiency then officer will issue Acknowledgement in RFD 02 within 15 days from the date of receiving application but if there is find any deficiency then officer will issue RFD 03 to rectify the deficiency.

Officer will issue 90 % of Total amount of refund Within 7 days from the date of Acknowledgement in RFD 02.

Officer will issue 100% of amount of refund within 60 days from the date of application receipt after completing full assessment.

If officer fails to issue 100% refund within time specified then refund will be issue with 6 % p.a. interest

FORMULA FOR CALCULATION OF GST REFUND AMOUNT

Refund Amt. = (Turnover of Zero-Rated supply of Goods+ Turnover of Zero-Rated supply of

services) * NET ITC/ Adjusted Total Income

Turnover of Zero Rates supply of services - invoices has been raised and convertible foreign

exchange has been received during the tax period.

+ any advance money received.

NET ITC - Total ITC availed during the period – ITC related to specified turnover under rule 4A , 4B

Adjusted Total Turnover – Total turnover – Exempted turnover – Turnover under rule 4A, 4B

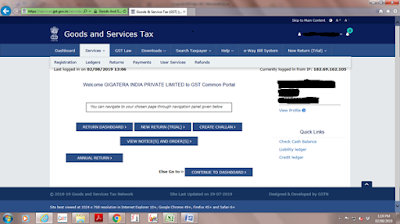

PROCESS TO CLAIM GST REFUND IF BALANCE OF ITC SHOWING

APPLICATION FOR REFUND

ii) Then refund window will be open select type of refund in which you fall

iii) Select tax period for which application is to be filed

iv) Then click on “create” button then a window will display “DO YOU WANT TO FILE NIL REFUND FOR THE SELECTED PERIOD “you have to click on “NO”

v) Here is opened a refund application form

vi) Fill “statement 1A” you can fill it directly on portal or you can go for “Download offline utility”

Validate

you sheet by clicking “VALIDATE & CALCULATE”

Then create file by clicking “CREATE FILE TO UPLOAD and save it

vii) GO to portal click on” click to fill the detail of invoice for inward and outward supplies”

viii) Then “statement 1 “will automatically reflect “ITC amount” rest column Turnover, Taxable value, and adjusted total turnover fill manually.

“uploading supporting documents” if you have calculation sheet you can have attached if you do not have then no Mandatory

Then you will get message “your refund application is successfully filed “and ARN ………

Author

Comments

Post a Comment