EXPORT UNDER GST REGIME

There are two terms of export which has been define under the GST Law.

a) Export of good - good which are to be taken out of India to a place outside India.

b) Export of services – supply of services shall be treated as export if following conditions are satisfied.

i)The supplier of service is located in India.

ii)The recipient of service is located outside India.

iii)The place of service is outside India.

iv)The payment of such service has received in convertible foreign exchange

v)The supplier of service and recipient of service are not merely establishment of a distinct person

EXPORT IS ZERO – RATED SUPPLY

Zero- rated supply – means a supply of good and services on which no tax is payable but credit of the input related to that supply is admissible .ITC is available for set-off against tax payable on domestic transaction and in case of excess input , there is suitable mechanism for allowing refund of ITC.

EXPORT COVER UNDER IGST ACT

Export of goods and/or services to be deemed as supply of goods and/or services in the course of inter- state trade or commerce, hence it is covered under IGST Act.

PROVISION FOR EXPORT

There are two type of process of export.

1) With payment of duty (tax)

In this process exporter have to pay tax (IGST) after that exporter can apply for refund .

Example : An exporter has

Tax liabilities (IGST ) amount of Rs 100,000

(-) ITC available Rs 50,000

Balance liability is Rs 50,000

Exporter will be liable to pay tax amount of Rs 50,000. And he will claim refund amount of Rs 100,000.

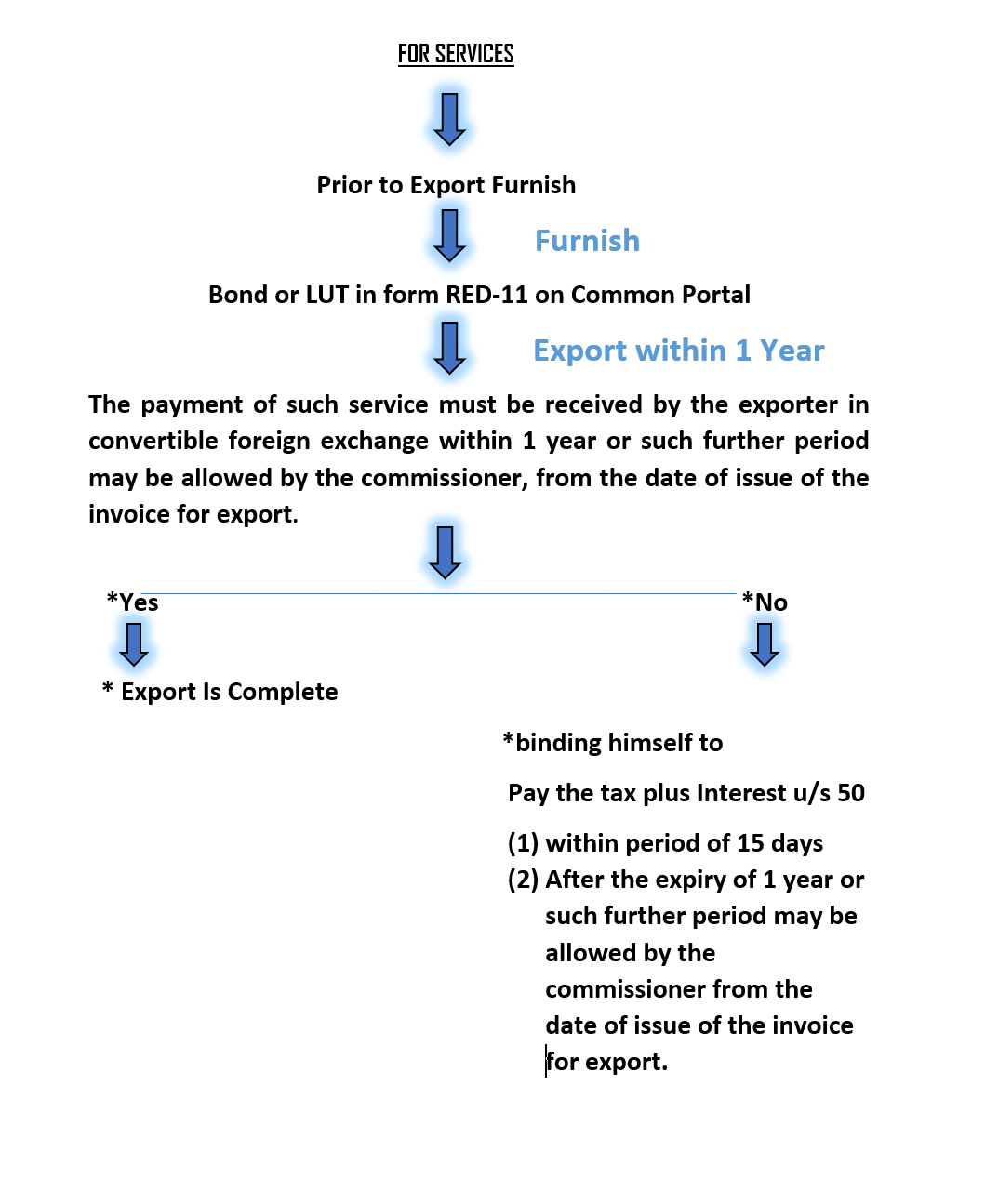

2)Without payment of duty (tax)

There are two provision of export without payment of duty

i)Bond - bond is perpetual ,it is not require to renew . bond would cover the amount of estimated tax liability which is self-assess by the exporter if tax liability increases in future then additional bond can be submit. also, exporter is required submit bank guarantee 15 % of value of bond. this rate can be reduced with the prior permission from commissioner. bond value should not be less than outstanding tax liability.

ii)Letter of undertaking- if exporter has prosecution more than amount of Rs 2.5 crore then he cannot apply for LUT. LUT is valid only for financial year in which LUT is furnished, it is required to renew every financial year

DOCUMENTS REQUIRED FOR LUT

i) Form GST RFD 11

ii) Letter of Undertaking

iii) GST Reg certificate (form REG 6)

iv) Authorisation Letter with ID (in case of company , partnership firm)

v) Copy of IEC certificate

vi) Company – certificate of Inc

vii) Firm- partnership deed

viii) Declaration on stamp paper

ix) Copy of PAN

x) ID of 2 Witnesses (self Attest)

Comments

Post a Comment